Brief Overview of Inflation

In simple terms, inflation is the rate at which prices increase for a given period of time. An increase in inflation tends to increase the cost of living due to a surge in the prices of various commodities. It is the policy of central banks to monitor the inflation rate and control the same to project economic stability. Major factors affecting inflation rates include money supply, employment rates and supply chain disruptions. So what is the effect of inflation on investors? It is good or bad? All your doubts will be clear here before that let us discuss a few more things to expand your knowledge area.

Also check our article on effect on interest rate on investments by clicking here.

Methods to measure inflation

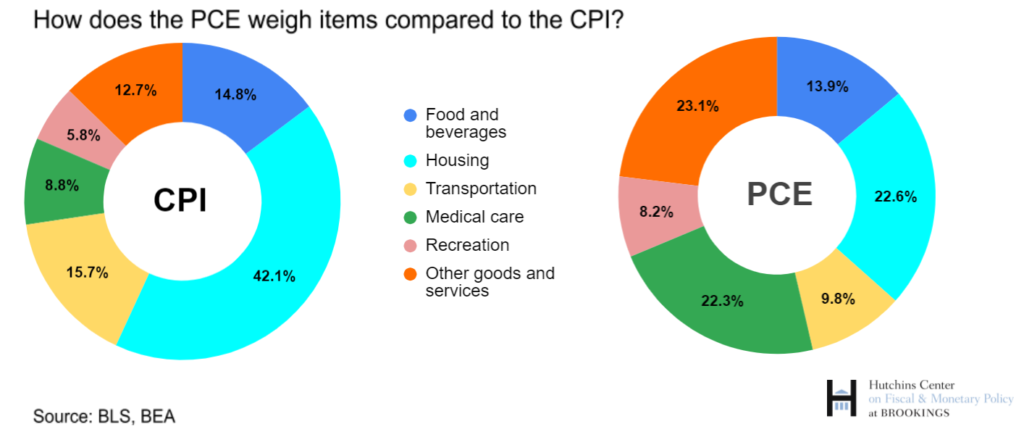

The well-recognized indicator of inflation is the Consumer Price Index (CPI) method. It is used to determine the percentage changes at which the price of goods and services consumers by household changes. It is calculated by dividing the current product price total by the past price total and multiplying the result by 100.

The other well-known measure is known as Personal Consumption Expenditures (PCE). It caters to the value of the goods and services purchased by or on behalf of residents in the US. It is determined every month on the basis of BEA data on personal consumption expenditures collected from US statistical reports.

Interested in Bitcoins? Check Bitcoin Price Prediction 2030 by clicking here.

Understanding the core types of inflation

You may come across various types of inflation, but today we will discuss the most necessary ones.

Demand-pull inflation takes place when the demand for goods and services exceeds the supply in an economy. In this scenario, the supply is not able to meet the aggregate demand given it either decreases or remains constant.

Cost-push inflation occurs when the cost of production increases triggering the rise in the price of goods and services. This takes place when the increase in production results in surges in the expenses of wages and raw materials decreasing the purchasing power of consumers.

Built-in inflation can be seen when workers tends to demand higher wages to overcome the rising cost of livings. Therefore it is also called wage-price spiral as it results in a loop as the businesses have to increase prices of commodities which further increases the cost of living for workers.

Effect of inflation on investors

Inflations significantly impact the purchasing power of a consumer while reducing the real value of your investments. In simpler words with an increase in inflation, the real value of investments decreases. For example, if you have earned 10% after 2 years from stock markets but the inflation rate has increased to 12% then this indicates that the value of investments has not increased but decreased by 2% (12% – 10%). Furthermore, higher inflation reduces stock value by making the market more bearish with eroded liquidity.

Learn about the the 1% decrease in Nifty and Sensex by clicking here.

Impact of increasing and decreasing inflation

Rising inflation results in lowered purchasing power, slower economic growth, higher interest rates, and other economic limitations. This triggers the rise in food costs, utility expenses, and non-incremental wage rates. However, slight inflation is necessary to maintain a stable economy and a healthy growth rate.

Lowering inflation tends to make the cost of living more affordable for the general public, who can access surplus money for investment planning while enjoying quality living. In addition, this also results in stability for business and affects future decisions increasing overall market returns. However, very low inflation can lead to recession where industrial activities are at low levels and unemployment rates increase with low business expansion.

Strategies for Investors

Investors should focus on increasing their investment rates to beat changes in inflation. This can be done through diversification in the portfolio with different asset classes such as stocks, gold, cryptocurrency and bonds. Nonetheless, gold is recognized as the best asset for beating inflation as the price of gold increases with an increase in inflation. You should strengthen your financial planning with a keen knowledge of investing to navigate the effect of inflation on investors.

Know about the best investment advice by clicking here.