The Current State of the Indian Stock Market

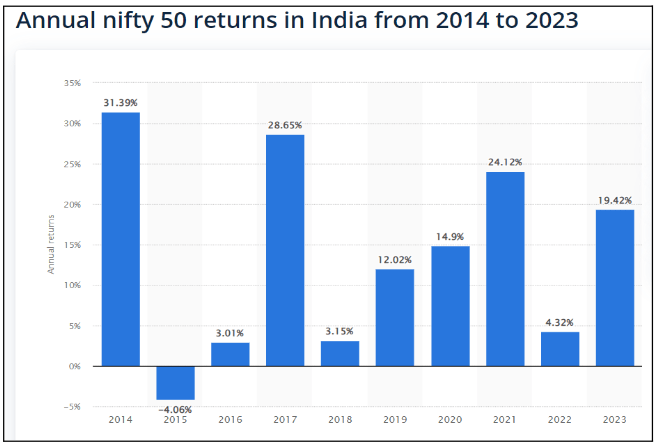

The Indian Stock Market is characterized as one of the best-performing markets across the globe. India has two stock exchanges the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). NSE is one of the largest growing markets with more than 80 million new investors in 2023. The Nifty 50 of India has provided annual returns after 2016. The figure below shows that in 2023 the Nifty 50 has generated around 19.24% in compounding rate.

With Elections going on and the result ahead on the 4th of June, the market is highly volatile. Other key areas currently affecting the market include Gift Nifty, monthly F&O expiration, weak global cues and its GDP. On Thursday the stock market experiences a fall in SENSEX by 617.30 points and in Nifty 50 by 216.05. However, given rapid economic developments and global advancements, the Indian Stock market has a long way to go.

Click here to learn about the 1% decreased in Nifty and Sensex.

Learn how to build a portfolio of stocks by clicking here.

Critical Trends to Monitor in 2024

Technological Advancements

India is experiencing rapid technological advancements in the fields of Artificial Intelligence, Machine Learning and Blockchain technology. The revenue from the computing market in India is projected to reach $17.1 billion by the end of 2024 with a CAGR of 5.51%. India is presenting itself as an emerging hub of innovation with strong opportunities in the domestic technology sector with a vibrant ecosystem. Quantum computing, autonomous vehicles, augmented reality and cybersecurity are a few of the major aspects of the incremental trends in the Indian technological industry.

Environmental, Social, and Governance (ESG) Investing

With the occurring issues of global warming, climate change and corporate scams the importance of ESG is seen in Indian Organizations. The key trends in ESG in India include increased relevance of mental health in the workplace, reduction of carbon emission, incorporation of renewable sources of energy and the implications of climate-tech solutions. Companies adhering to strict ESG protocols are sure to have an expanding customer base given the increased focus on sustainability. A few such ESG stocks include Infosys, HDFC, Wipro, ICICI Prudential and Aditya Birla Sun Life ESG Fund.

Talking about ESG click here to know about the ultimate truth about the Gangotri Glacier Meltdown.

Global Political Climate

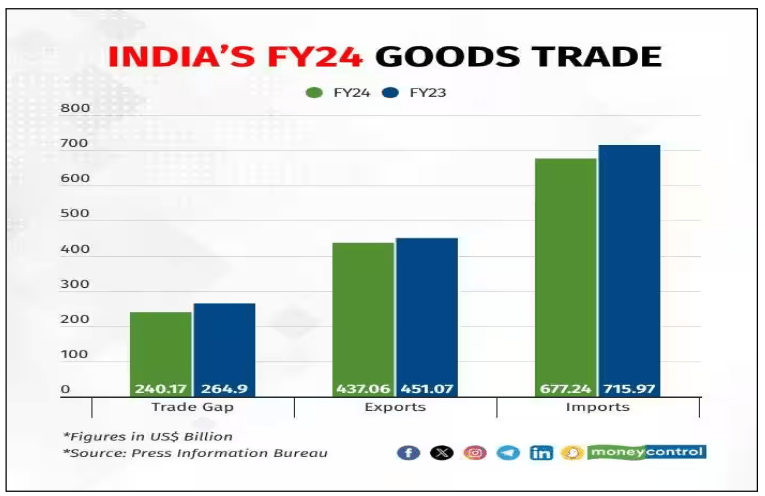

Our analysis has found that India is anticipated to become a central destination for global exports and imports in 2024. However, there exist some disputes with China and Russia which could result in an increase in inflation and energy costs hindering the profit potential of companies. Regardless of the global slowdowns, India is one of the fastest-growing economies in the world, with emphatic foundations for structural changeover and prospective development.

Click here to learn about the effect of interest rates on investments.

Best Investment Advice 2024: Strategies

Diversification

There is a saying in the investing world: “Don’t put all your eggs in one basket”. If anything happens to the basket you will lose all your eggs. This can be mitigated through the strategy of diversification. This strategy includes the practice of spreading your investment across stocks from different companies and industries to reduce the overall volatility of your portfolio. We suggest that you should further diversify your portfolio by investing in asset classes such as cryptocurrency, bonds, mutual funds and gold.

Check our article on Bitcoin price prediction 2030 by clicking here.

Value vs. Growth Investing

The strategy of value investing is the method of picking stocks that are trading for less value in comparison to their book value. In simpler terms, buying the stocks whose market price is lower than the book price. On the other hand, growth investing focuses on increasing the capital of investors by investing in new or small companies with growth potential. However, high capital is not useful if it has not enough potential to increase the wealth of investors. Contradictory, value investing has lower risk and in the majority of areas has outperformed the growth investing strategy.

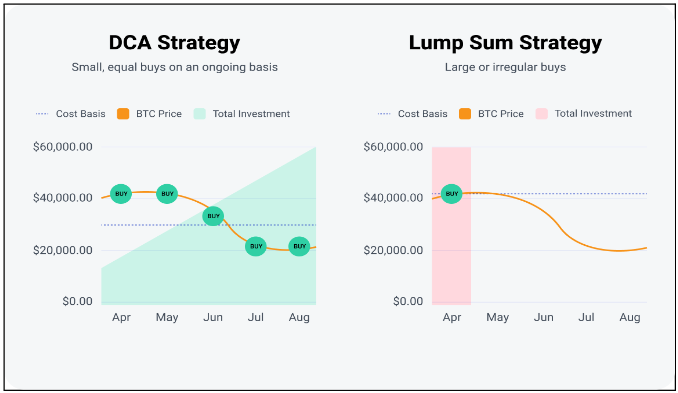

Dollar-Cost Averaging

This strategy is one the easiest methods to boost your returns while navigating high risks. It is defined as the practice of investing in a fixed dollar amount on a regular basis despite the share price. This boosts the experience, discipline and investing habits of newbie investors. This involves investing the same amount of money in a target asset class regularly over a certain period which leads to increasing interest due to the compounding nature of the stock market.

Sectors to Observe

Renewable Energy Sector

Electricity generation in the renewable energy market is expected to amount to more than 390 kWh in 2024 with an annual growth rate of 4.94%. This is supported by the 70 GW tender of renewable energy achieved by the renewable energy developers in India. Therefore, investment opportunities in wind, solar, hydropower and other renewable will show remarkable progress in 2024. Major Indian companies in this sector include Tata Power, Adani, Suzlon and Azure Power.

Healthcare Sector

The revenue from medical technology is forecasted to reach $8.71 billion in 2024 with a growth rate of 7.61%. Given advancements in technology such as genomics and big data analytics in the pharmaceutical companies the sector will witness an effective boom. India’s MedTech sector is supported by innovation-based growth and cost-cutting measures with Artificial Intelligence. Cipla, Reddy’s Laboratories, Sun Pharma and Glenmark are among the few innovative companies to emerge in the Indian Market.

Technology Sector

With the growing increase in the tech industry and IT services the revenue of the technological sector reached $227 billion in 2022. The major advancements supporting this sector in India include the emergence of 5G, Robotics, Computing, the Internet of Things and Artificial Intelligence. Emerging Tech Giants in India includes TCS, Wipro, Mphasis and Infosys.

Risks and Considerations

Market Volatility

The normal rate of volatility index in India ranges between 15 and 35. A value near 15 demonstrates the presence of low volatility and s score closer to 35 indicates the presence of a high risk of volatility. The current score of Nifty is 24.60, indicating that there are possible chances of market volatility which could lead to market falls. This risk can be mitigated by portfolio diversification and determination of personal risk tolerance.

Regulatory Changes

Given the upcoming election results, there are high possibility of changes in political guidelines and regulations. The probable establishment of new tax regimes and changes in standards could hinder the profit potential of different companies and force them to change their business model. Hedging against options and futures is an effective strategy to safeguard from the risk of regulatory challenges.

Economic Downturns

No economy is prone to the threats of economic downturn. Even India was in recession too in the time of the COVID-19 pandemic. Safe-have assets should be considered to avoid such threats and protect your investments. Investing in mutual funds is the safest option to consider for navigating the scenario of an economic downturn.

NOTE: This article on “Best Investment Advice” is just a guide to investors disclosing trends and emerging sectors in 2024 and fostering an understanding of the Indian stock market. It is advisable to conduct your own research and analysis before buying certain stocks. Thank You!