Meaning of credit score

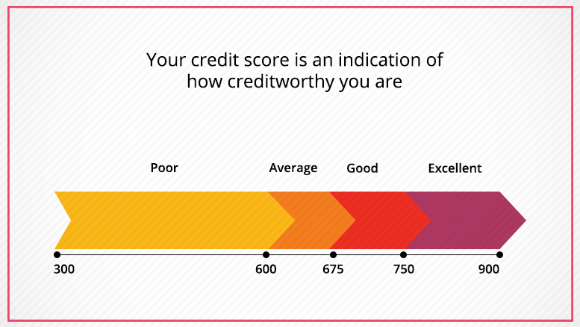

A credit score can be defined as the prediction of your credit behavior determining the likelihood of how easily you can pay back your loans and debts determined through your credit reports. When you apply for a loan, the first thing that is enquired about you is your credit score, making it an important area to be considered. We will help you to improve your credit score in 30 days with just a few simple steps.

Also learn the basic of investing by clicking here.

Initial Steps for how to improve your credit score in 30 days

It is not a thumb rule that your score is decreased only by your actions. Technological errors and potential disputes by credit bureaus may have led to a reduction in your score. First, you must check your score through online software and make sure that any fake loan and EMI are active in your name. You can apply to run an enquiry on the fake loans which will increase your score in a few days.

Your next priority should be to pay off your credit balance as much as possible. This will reduce your credit utilization percentage, indicating that you are less dependent on loans which will increase your score. A very high credit utilization will negatively impact your score as institutes will be under the impression it is risky to grant you loans.

Make sure to check out article on the impact of inflation and interest rate on investment by clicking respective links

Practical Strategies to Boost Your Score

Suddenly paying off your debts may be not as easy as it sounds. So how else can you reduce your credit utilization to boost your credit score? You should request to increase your credit limit to your credit card providers. Increasing your spending limit will reduce your credit utilization simultaneously making your credit score more optimum. However, you should not use your increased limit rather you should focus on saving the increased limit to improve your credit score in 30 days. The other step is to use only an authorized payment account to make your payments. This will help to improve your score when you make your payments within your specified time.

Managing Existing Accounts

The most important method to enhance your score is to make timely payments. You can set up payment reminders or automatic payment options to avoid payment delays which otherwise will reduce your credit score. Never hesitate to negotiate for a lower interest rate. Negotiating with your credit can decrease your interest rate and even lead to a reduction in card fees with possible discounts. This is helpful for paying previous debts and boosting your credit score in 30 days.

Learn about bitcoin price prediction 2030 by clicking here.

Additional Tips and Tools

Avoid frequent applications for new credit cards, as the recurring applications will increase inquiries resulting in a decrease in your credit score. Just focus on improving the performance of your current account to enhance credit points. Do not close your old accounts as the length of your credit history makes up around 15% to 20% of your credit score. Therefore a long credit history is a key element in improving your credit score in future. Stay away from unbelievable offers, as they are mostly scams. Just use secured credit cards and credit builder loans with effective responsibility.

Monitoring and Maintaining Your Credit

Regular monitoring of your credit score is a simple yet effective step in managing your expenses. You should review each section of your credit report especially the areas such as repayment history, account status, inquiries made and other personal information. Develop a budget to manage your current debts and avoid credit issues. This will help to systematically plan your expenses on the basis of their relevance.